Summary: Recently, China's

soybean imports from Brazil hit a new weekly high. In early April, 40 - plus

shipments (2.4m tons, 1/3 of monthly processing) were procured. The 145% tariff

on US soybeans (versus 8% for Brazilian, with lower CIF) from China - US trade

friction shifted imports. Brazil, having supply edge, strengthened its trade

status. China diversifies imports and green - upgrades supply chains to handle

risks and reshape trade.

Recently, the scale of China's soybean

procurement from Brazil has hit a new high in a single week, drawing

significant attention from the international market.

According to media reports, Chinese

importers purchased at least 40 shipments of soybeans from Brazil in the first

half of April 2025, with a total procurement volume of 2.4 million tons, which

is equivalent to one-third of China's monthly soybean processing volume.

Background

This procurement scale far exceeds the

normal level. Firstly, it is affected by the China-US trade friction.

Currently, the tariff imposed by China on

American soybeans has been increased from 3% to 145%, while Brazilian soybeans

enjoy a preferential tax rate of 8% through the BRICS cooperation mechanism.

This differential tariff policy has

directly prompted Chinese enterprises to shift their purchases to Brazil.

For example, the cost, insurance and

freight (CIF) price of Brazilian soybeans is $18 to $22 lower per ton than that

of similar American products, presenting a remarkable cost advantage.

In addition, the share of American soybean

exports to China has plummeted from 38% in 2024 to less than 22% currently, and

its market share has been rapidly taken up by Brazil.

This also requires Brazilian soybeans to

have their own supply advantages.

The expected soybean output in Brazil in

2025 is 175.45 million tons, an increase of 11% year-on-year, and the export

volume is expected to rise to 107 million tons.

The expected soybean tranalysis.com/Analysis/Index#item1?KeyWordID=1ea6f8b39ff44ad4becec20c63502df5&PublisherID=b3fac7dd-9156-424c-9843-193631ebb67b' target='_blank'>export volume from

Brazil in April is 13.3 million tons, among which about 76% is destined for

China.

Through the optimization of the

"port-railway-warehousing" trinity logistics system, Brazil has

reduced the soybean transportation cycle to 49 days, which is 25% more

efficient than the route from the western United States, ensuring the stability

of the supply chain.

Previously, the price of Brazilian soybeans

increased due to the tense situation between China and the United States, but

the recent price drop has provided a window of opportunity for Chinese buyers.

Global

Pattern

This event has already shown that Brazil

has replaced the United States as China's largest soybean supplier. In 2024,

Brazil's exports to China accounted for 76% of its total export volume.

This procurement has further strengthened

Brazil's core position in the global soybean trade.

By establishing a China-Brazil agricultural

innovation fund of $5 billion, Brazil has achieved technological breakthroughs

in areas such as transgenic breeding and precision irrigation. The soybean

yield per hectare reaches 3.8 tons, which is 12% higher than that in the

Midwest production areas of the United States.

China, on the other hand, has deepened its

cooperation with Brazil through the "production area processing - targeted

supply" model. For instance, the 2-million-ton oil crushing plant newly

built by COFCO Corporation in Mato Grosso, Brazil, will be put into operation

in 2026.

Meanwhile, China is promoting the

diversification of soybean imports. It is expected to import about 10 million

tons of soybeans from South American countries such as Argentina in 2025,

further diversifying risks.

The export revenue of American soybeans to

China accounts for half of its total exports. However, this procurement boom

has caused the soybean price index of the Chicago Mercantile Exchange to drop

by 14% in a single month, and about 8.5 million tons of inventory are at risk

of being unsalable.

Caleb Regan, President of the American

Soybean Association, warned that American farmers are already facing

"potential significant losses" in 2025.

China's

Response Measures

China's soybean imports are mainly used for

crushing soybean meal to meet the needs of the livestock industry.

The No. 1 Central Document in 2025 proposed

to stabilize the pig production capacity, with the target of maintaining the

normal inventory of 39 million breeding sows. At the same time, it promotes the

upgrading of the beef cattle and dairy cattle industries, and the feed demand

remains persistently rigid.

Although China's domestic soybean

self-sufficiency rate has increased to 20%, the gap between production and

demand still needs to be filled by imports.

While expanding procurement, Chinese

enterprises are also promoting the green transformation of the supply chain.

For example, COFCO Corporation signed a

procurement agreement for 1.5 million tons of "deforestation-free"

soybeans with Brazil, requiring that the soybean planting areas have not been

involved in deforestation since December 31, 2020, and ensuring sustainable

production through third-party audits.

The high tariffs imposed by China on

American soybeans may be long-term, and potential risks such as the logistics

bottlenecks (such as port congestion) and price fluctuations of Brazilian

soybeans still exist.

To this end, China is deepening its

agricultural cooperation with South American countries through the Belt and

Road Initiative and exploring emerging soybean production areas in Africa and

other regions to build a more resilient supply chain.

This large-scale procurement is not just a

short-term market behavior, but also a strategic layout for China to deal with

global trade uncertainties.

This

trend will also reshape the global soybean trade rules. With its advantages in

production capacity, cost and policies, Brazil is expected to further squeeze

the market share of the United States, while China's bargaining power as the

largest buyer will continue to increase.

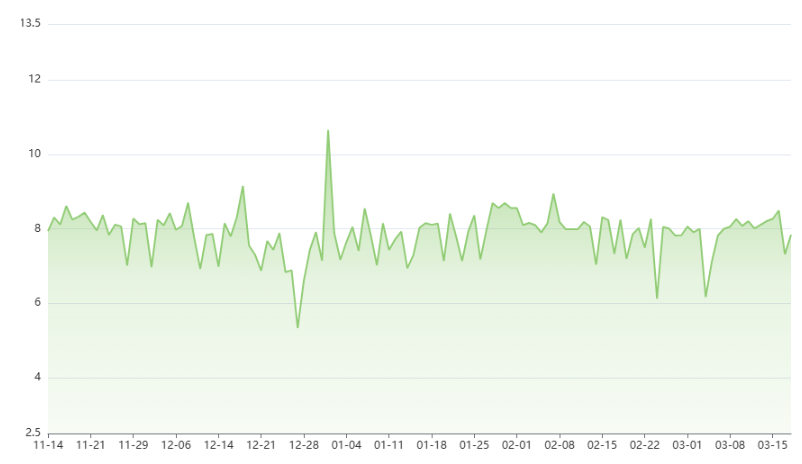

The following is the recent price trend

chart of soybeans in the Chinese market. In the near future, relevant

information will soon be available on our official website. If you have an

interest in this aspect, we highly recommend that you do not overlook this

valuable opportunity.

About CCM:

CCM is the leading market intelligence provider for China's agriculture, chemicals, food & feed and life science markets. Founded in 2001, CCM offers a range of content solutions, from price and trade analysis to industry newsletters and customized market research reports. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.